GST implemented: List of items to be costly from July 1 under Goods and Services Tax regime

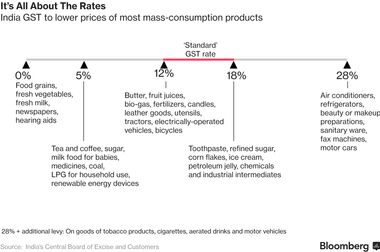

The GST has been primarily categorised into four tax slab rates- 5%, 12%, 18% and 28%. Gold, rough diamond has been taxed under a separate slab of 3 per cent.

New Delhi, July 1: Starting July 1, India has braced the single biggest tax reform- the Goods and Services Tax (GST).

The nation witnessed launch of the biggest tax reform since its

Independence during a midnight session at the Central Hall of Parliament

at 12 AM on July 1. The most anticipated indirect tax regime was rolled

out in presence of top dignitaries including Prime Minister Narendra

Modi, President Pranab Mukherjee, the Council of Ministers of Modi

Cabinet, BJP President Amit Shah, Lok Sabha Speaker Sumitra Mahajan,

Vice President Hamid Ansari.

GST is the first of its kind system in

India when both Centre and State shall be putting consolidated efforts

in the same direction. The newly introduced GST is a landmark achievement which

is bound to take the nation towards exponential growth. GST shall play a

key role in helping us build the India of our dreams. The much

anticipated mega event was awaited by 1.25 billion citizens of the

country and is believed to be the disruptive change that will give a

fillip to the Indian economy.Here are products that will now become expensive after implementation of GST on July 1, 2017

The GST rates

will bring in tax parity across the country and will lead to a regime

of ‘one nation, one tax’. The GST has been primarily categorised into

four tax slab rates- 5%, 12%, 18% and 28%. Gold, rough diamond has been

taxed under a separate slab of 3 per cent.

- Mobile phone bill: After the GST rollout, an individual’s mobile bill is likely to get more expensive as a three per cent increase in the rate of tax under GST on telecommunication services is envisaged. One will have to shell out more post-July 1.

- Banking Services: Banking and financial services have been placed in the 18 percent rate slab under GST, as compared to 15 per cent service tax earlier. This means that the current rate stands increased by three percent. ATM withdrawals, cheque book issuance, demand drafts and cash deposits will get costlier from July 1 with the implementation of GST.

- Credit card bills to get costlier: Individuals will have to shell out more for credit cards bills after the goods and services (GST) rollout as financial services would attract a higher tax of 18% as against 15% as of now.

- Personal care product: A wide range of personal care items including deodorants, shaving creams, after shave lotions, hair shampoo, dye and sunscreen are in the highest tax slab as well. Articles of leather, saddlery, and harness, travel goods, handbags and similar containers; articles of animal gut will become expensive under GST.

- Insurance premium to get costlier: After the goods and services (GST) rollout, the rate for insurance services has been kept at the standard rate of eighteen per cent including health insurance policies, which is a three percent hike against the existing regime.

- Cigarettes: Under GST, cigarettes have been put in the highest tax slab of 28 per cent. All tobacco-based products have been put under the highest slab of 28% of the marked price, with 12% additional cess called sin tax. For example, if the marked price on a cigarette packet of 10 sticks is Rs 40, the retail market price would be Rs 56 (Rs 11.20 as tax and Rs 4.80 as ‘sin tax’).

- Home appliances to get costlier: Under the GST regime, home durables like water heater, dishwasher, weighing machine, washing machine, Air-conditioners, vacuum cleaner, shavers and hair clippers have been clubbed together in the highest 28% slab.

- Sanitary napkins: Sanitary napkins, much to the displeasure of many people will not be cheaper with the rolling out of the Goods and Services Tax (GST), a report claimed. As this historic tax reform is all set to be launched at midnight, the country wanted sanitary napkins to become tax-free. As per reports, sanitary napkins are taxed at 12 percent under the GST.

- Hotel stays: If you are planning a vacation, you will have to think twice before spending as your vacations are likely to cost more after GST. Under the new tax regime, hotel room tariffs between 1,000 and 2,500 INR bracket will attract a twelve per cent levy while hotels with room rents above 7,500 INR will attract a 28 % GST rate.

The GST Council has developed such

systems wherein the underprivileged get all the promised facilities. The

people connected with GST have gone beyond politics and unanimously

contributed to ensure the welfare of the poor class. All states are

slated to gain immensely as they shall now get equal opportunities of

development.

The old India was economically

fragmented, the ‘New India’ is believed to create One Tax, One Market

and for One Nation under GST. India will be a nation where the Centre

and the States will work together cooperatively and harmoniously towards

the common goal of shared prosperity. The implementation of GST is an

important achievement for the whole country as it will awake to

limitless possibilities to expand the nation’s economic horizons across

the globe.

No comments:

Post a Comment